Here’s a fact: To stay competitive, you can no longer think of yourself as only an orthodontist. You are a business owner. And as such, you need to have the knowledge to make sound business decisions for your practice, ones supported with applicable data. That’s why Orthodontic Products, in partnership with OrthoFi, is launching a new column, Inside the Numbers.

[sidebar float=”right” width=”350″]

Q: When patients get to choose their plans, what does the data show that they actually choose? My practice is in a high-income area. Do I really need more flexible options?

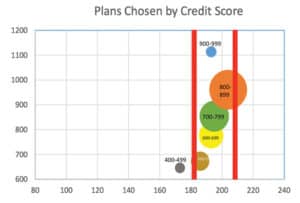

A: Our data comes from over 100,000 fee presentations, where patients were given open choice from a wide array of options on down payments (as low as $250 all the way up to pay-in-full) and monthlies (from 3 to 36 months for most patients). Our solution also handles financial profiling (including soft credit checks), which directionally translates to household income level, so we can analyze plan choice trends by income brackets. The results are pretty interesting. As one might expect, higher credit/income patients tend to choose a bit higher average down payments, with the highest tier averaging just under $1,100 down. Note for those demanding $1,500+ or more for Invisalign: You are still stretching your highest income families. However, the story on monthlies is very different. Our data shows that the average monthly choice across ALL credit tiers (excluding exceptional sub-500 FICO patients) is clustered tightly between $187 and $205. What does that mean? It means pricing for orthodontic treatment is not as elastic as many believe. So even if your patients have a higher income and they value quality and technology, they feel this service should be about $200/mo.

Q: I want to be more flexible with my fees, but I’m worried about longer plans not paying. I’d like to charge interest, but will patients pay interest for longer plans?

A: Instead of managing risk by restricting terms, why not do what successful businesses do: charge low interest to hedge the risk of extending payments? But will orthodontic patients pay interest? Many think “no,” but we believe that consumers expect to pay interest on large purchases, so why would orthodontics be any different? Here’s what the data shows: on average, 10.5% of all patients (as high as 15% in some practices) will pay interest in exchange for more affordable monthly terms. The key is that the interest is offered only for extended plans, so it encourages patients who can afford it to avoid interest and pick more balanced length plans. On the other hand, if they need a lower monthly payment, patients can go longer, with the rate scaling with length. Of course, TCs need to reinforce that there are lots of interest-free options, but extended financing allows your office to offer even more affordable choices.

[/sidebar]

OrthoFi, a software and service company founded in 2013 by a group of orthodontists and business professionals, set out to help practices grow with better on-boarding and financing processes, while also streamlining back office processes—everything from determining insurance eligibility verification to collections.

Because OrthoFi engages with the patient directly at on-boarding, it has been able to gather a wealth of patient data that goes beyond most practice management systems that focus on practice performance. Currently, the company’s data represents over 100,000 consults and 75,000 patient starts. This data includes patient demographic information that can be cross-referenced with everything from patient financing preferences and their risk profile, to price sensitivity and acceptance of interest. With this data, practices can make informed decisions about patient financing and help dispel the myths that may be hindering practice growth.

With this column, Orthodontic Products and OrthoFi want you to ask questions about what does and does not work. The data will provide you with insights into patient and practice behavior that can help you make informed decisions.

David Ternan, OrthoFi’s president and CEO, will be answering your questions. Ternan has spent his career in business and management consulting, with over a decade at Accenture and Slalom Consulting, helping organizations like Pepsi, Dow Chemical, Caterpillar, and General Motors transform. Ternan has seen OrthoFi grow from an idea on a piece of paper to a thriving business with over 95 employees.

“I think what we’ve been able to build at OrthoFi, in terms of the data collected, is extremely valuable,” Ternan says. “Now, we want to share the insights that we’ve been able to glean over the last 4 years to really help orthodontists run better businesses. We want them to make smarter decisions on how to make things more affordable for patients, on how to provide patients with better experiences, and on how to run their business in a better way.” OP

[sidebar float=”center” width=”500″]

Submit your questions to Inside the Numbers at [email protected].

[/sidebar]