The results from the 2023 Orthodontic Practice Survey uncovered a slight decline in production and confirmed the lingering staffing challenge.

By Roger P. Levin, DDS

In this third consecutive year of the Orthodontic Products/Levin Group Annual Orthodontic Practice Survey, we are excited to share these important insights about the orthodontic specialty. In addition to the incredibly useful and interesting data provided by this year‘s orthodontist respondents, this article also outlines practical suggestions and recommendations to help you apply this information to your practice and your career.

This survey of orthodontists only was conducted in early January 2024. Of those who responded, 68% practice solo, 18% are in a two-doctor practice, 7% are in a three-doctor practice and 7% have four or more orthodontists in the practice. Orthodontists were asked to consider their practice performance for the full year of 2023 when providing their answers. The average age of all respondents was 54. In this group of orthodontists, three-quarters were male and one-quarter female.

First things, first. Where is production headed?

Overall, the changes in the financial numbers reported were nominal from 2022 to 2023. The one change of note though is that the average production per orthodontist declined 4.7% from $1,611,324 in 2022 to $1,535,084 in 2023. This is the first time in 3 years of this survey that we have seen a decline in production per doctor. Although a 4.7% decline is generally considered nominal, it is statistically significant. The big question is whether or not this is the start of a trend.

One possible explanation for 2 years of production increases (2021 and 2022) followed this year by a decrease could be that patient spending on orthodontic treatment was still being buoyed in 2021 and 2022 by post-pandemic spending habits. Beyond the pent-up demand for all healthcare services, many people had significant excess savings due to not spending money on entertainment, restaurants, travel, and luxury during the pandemic period. This led to stability in orthodontic practice production for several years coming out of the pandemic, which appears now to be waning.

Overall, U.S. consumer spending has been strong, but credit card debt is increasing again (reaching new heights) which may indicate that people are running out of excess savings. I have noted during several periods of economic contraction over the past 4 decades that spending on orthodontic treatment is an early indicator of the general consumer attitude. Next year’s survey will provide much more insight as to whether or not this is simply a 1-year deviation, or a trend. Blip or trend, either way, orthodontic practices would be wise to pay attention to this data and immediately begin to implement the necessary systems and strategies to ensure that negative production trends don’t impact their practice.

This year we dug a little deeper to identify any variation in production based on market size.

Interestingly, production in 2023 for orthodontists practicing in small towns was roughly 25% lower than the other larger markets.

What does this production data mean?

In Levin Group’s experience, orthodontists as a group tend to be very optimistic. They create fun, high-energy environments that patients enjoy visiting and team members achieve high professional satisfaction. So, it should come as no surprise that, even in the face of slightly lower production, 85% of doctors in this survey reported that they expect to see an increase in production in 2024, and 89% of them expect to maintain a successful orthodontic practice in the coming years.

In order to accomplish that, orthodontic practices need to focus on improving and streamlining systems to enhance efficiency. The first consideration and highest priority is maintaining or increasing the number of new patient starts. In most practices, starts are influenced primarily by four factors:

1. The quality of referral marketing

2. The effectiveness of the new patient/parent phone call

3. The robustness of the observation program

4. The treatment coordinator process

Each of these systems should be regularly evaluated and upgraded where necessary. Systems are one of the key factors in production as well as team training, performance and longevity.

Next up? What’s happening with practice overhead?

More than half (59%) of the orthodontic practices surveyed reported higher overhead in 2023 compared to 2022. That increase, on average, was 0.5%. Only 17% said their total overhead had improved and 61% listed rising overhead as their “biggest challenge” right now (Figure 3). While a half-point uptick in overhead percentage is indicative of some stability, and definitely better than the current inflation rate, any increase in overhead is problematic, should be addressed, and corrected if possible. Why? Because a 1% increase in overhead is the same as a 1% decrease in practice profit. This means that the orthodontist may be working harder for less income. For a doctor producing $1,500,000 (this year’s average), 1% higher overhead is $15,000 in lost income for the doctor. The one way to compensate for higher overhead (once you’ve reduced spending as much as possible) is to insure that production increases by a sufficient amount.

What does this overhead data mean?

Orthodontic practices need to continue to apply a laser-focus on overhead control—now more than ever. Before the pandemic, overhead in orthodontics was very predictable and hardly rose.

That changed in 2021 and 2022. If we combine the last 3 years’ overhead increases, many practices are experiencing anywhere from 10% to 12% higher overhead now than they did historically. Remembering the example above, this would represent a 10% to 12% lower profit, assuming production remained the same, which it did. The primary reason for the overhead increase in the last 2 years is staffing costs, which have risen significantly since the pandemic. But there has also been real inflation on supplies, materials, and technologies as well.

It is important to be aware of and reverse the trend of rising overhead. Production is the key to compensating for higher overhead. Overhead expenses can only be lowered by a limited amount. Eliminating unnecessary purchases, comparing prices for supplies and services, and eliminating waste are all techniques that need to be applied. Another idea to help control overhead is to offer a bonus to the staff member who does all of the ordering, for each 1% lower overhead he or she can achieve.

What’s happening with orthodontic patient volume and where are patients coming from?

Patient volume increased in the majority of practices last year. Almost three-quarters (72%) reported the same or higher total patient volume in 2023 versus 2022. And 61% reported the same or higher new patient volume in 2023. Both of these metrics are improvements from our 2022 survey and indicate the continued stabilization of patient traffic in orthodontic offices.

Patient volume is important, but the new patient number is the most critical. Orthodontic practices live and die based on referrals (and converting those referrals into starts). Practices with strong new patient inflow are highly likely to have enough starts. If your new patient volume is declining, that is a large red flag and immediate action should be taken to invigorate the referral marketing program, improve the new patient phone call, maximize (or establish) an observation program and overhaul the TC process.

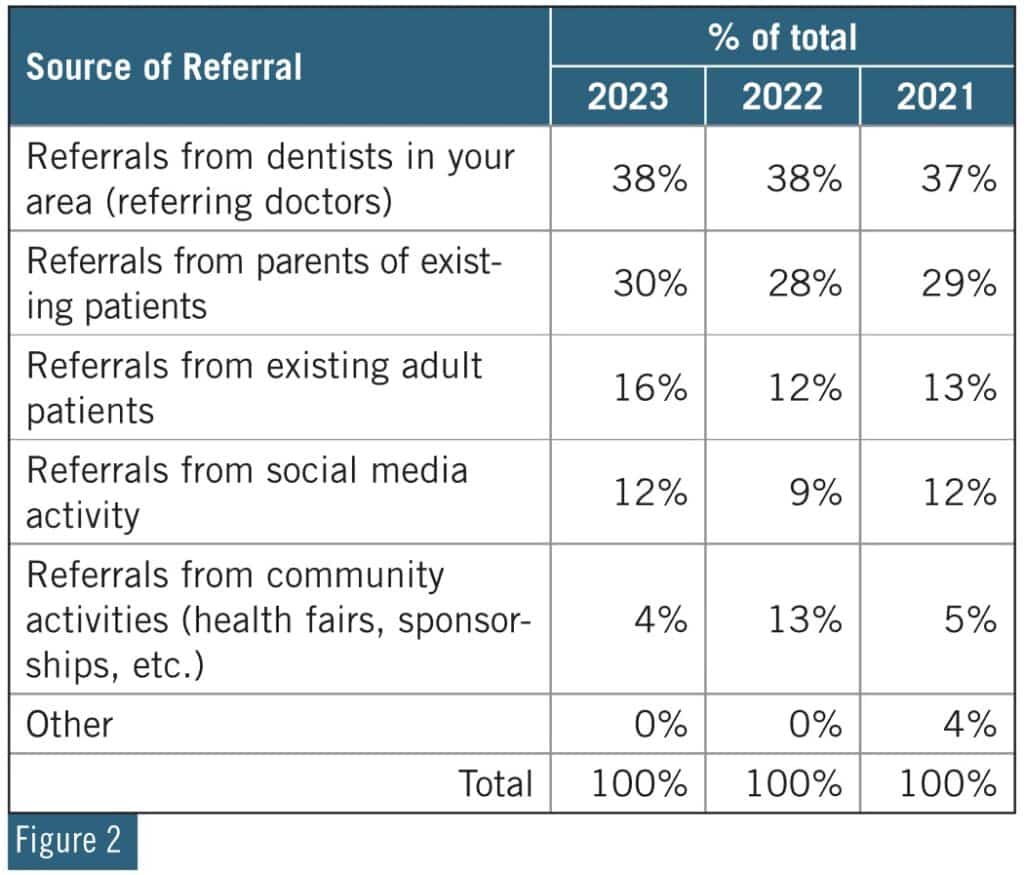

When asked to break down the source of their new patients, the respondents to this year’s survey answered as follows.

Interestingly, orthodontists in our survey reported that referring doctors in their area were responsible for 38% of their new patient traffic, making that the primary source of new patients. This was consistent with the results reported in each of the last 3 years. Levin Group data indicates that at least $3.6 billion per year of revenue is referred to orthodontic practices by referring doctors.

There was a slight increase in referrals from parents of existing patients this year as well as an increase in the number of referrals from existing adult patients. Social media continues to support new patient traffic.

Surprisingly, there was a major drop in the number of new patients drawn to practices from community activities such as health fairs and sports sponsorships. Perhaps those activities, which frequently result in interested parties looking for the practice online after the fact, contributed to the increase in social media being chosen as the source of the referral.

What does this information about patient volume and referral sources mean?

Referrals are the life blood of an orthodontic practice. Textbooks could be written on this subject, but the key to success is having enough referrals, generated by either supply-and-demand in the community or referral marketing strategies being implemented as a referral marketing program. Competition is increasing and patients have more options for orthodontic treatment. For example, one of the largest DSOs offers aligners in each practice for about $1,900. As competition continues to grow both in terms of a larger supply of providers for orthodontic care and lower fees, it is important to identify where referrals are coming from and implement the appropriate referral marketing strategies to address the competition.

Competition is only one challenge. What about the others?

Each year we ask orthodontists to identify the top challenges they are facing. Doctors were asked to select all that apply to them right now.

As you can see, more than 7 out of 10 orthodontists selected insufficient new patient starts as their number one challenge, propelling it to the top of the list. Not surprisingly, rising overhead and retention of staff remained high on the list. While inflation should eventually ease, reducing the concern about overhead, Levin Group believes the staffing crisis will remain present for at least the next 7 to 10 years.

And crisis is the operative word. It’s not a shortage, a limitation or a sluggish hiring economy. It’s a crisis and the numbers bear this out. More than 81% of responding orthodontists believe there is a “shortage” of orthodontic staff available for hire. When 81% think that way, it is a crisis.

Currently, 57% of practices are looking to hire a staff member—about the same as last year reflecting that this chronic condition has not improved at all. Right now, 58% of practices have at least one open position to fill. Only 1 in 8 practices reported having no staffing challenges at the moment.

Will this get better? Unfortunately, it takes time to train inexperienced staff, especially orthodontic assistants. It takes time to bring in and train front desk people and although there are more front desk or administrative people available, we also are finding that the skill set of candidates coming into practices is lower than in the past. It will get better, but probably not in the next several years.

When asking orthodontists what they are doing to address current staffing challenges, here are the top answers and some comments on each tactic.

- Increasing base compensation for staff—66% of respondents. Paying more for compensation has a direct negative impact on overhead and profitability unless you increase production to compensate.

- Providing more bonuses for staff—41% of respondents. Make sure that the bonus system is correctly designed and that staff members are fully aware of the opportunity to earn bonuses as part of their total compensation potential.

- Adding technology for productivity enhancement—42% of respondents. This is good for both practice efficiency and practice production and for giving staff members more time to focus on other tasks. Technology should either improve quality, speed, or efficiency, or provide a return on investment.

- Offering more/better employee benefits—23% of respondents. Some people need benefits and will not take or keep positions that do not offer them. Reducing benefits is often a precursor to losing staff members.

I would suggest that orthodontists have at least three staff retention processes in place in the practice and measure the average tenure of each staff member. If the average tenure is improving, that is a good vital sign. If it is decreasing, then practices need to reevaluate their vision, culture, and leadership, as well as issues such as compensation, team building, and staff satisfaction.

What is happening with starts and orthodontic fees?

The average number of total annual starts per orthodontist in our survey this year is 287. This is an approximate 5% increase over 2022.

In regard to fees, respondents reported charging about the same fee for complete treatment using either bracket and wire or aligners. The average fee for bracket and wire ($6,297) is up 4.5% from 2022. The average fee for clear aligners ($6,467) is up approximately 8.5% from 2022 (Figure 4). This is a positive trend in fees, especially when insurance reimbursements for orthodontic treatment remain relatively stagnant.

Of note, the highest reported fee for bracket and wire was $9,900 and the lowest reported fee was $3,500. The highest reported fee for clear aligners was $10,900 and the lowest fee was $1,800.

What is happening with patient visit intervals (time between checks)?

Respondents are seeing aligner patients much less frequently than bracket and wire. This is not a new trend.

In Levin Group’s broad overview of the orthodontic practice market, we are seeing an increasing number of practices moving toward 18 weeks or more between visits. For example, the longest interval reported in this survey for remote monitoring of aligner patients was 30 weeks. It seems that more and more practices (and patients) are becoming comfortable with the idea that longer intervals between visits can allow for excellent quality of care.

To what level is remote monitoring and teledentistry being adopted in orthodontics?

In our survey, 38% of orthodontists reported that they are using teledentistry or remote monitoring with patients. When we asked how they are using it, here is what we found.

Of those that reported using remote monitoring, their choice of platform is shown below.

So, what does this information about remote monitoring really mean?

Remote monitoring usage in orthodontics is increasing each year. An increasing number of orthodontists appear to be comfortable that they can use some form of remote monitoring and also maintain high levels of clinical excellence. Although we never comment on clinical care or orthodontic clinical technique, as an orthodontic consulting firm, Levin Group is in favor of remote monitoring in orthodontic practice because it expands available chair time, is more convenient in many cases for parents and patients, and creates efficiency improvements.

One more important fact to consider

Almost one-quarter (22%) of orthodontic practices do not have a full-time treatment coordinator (TC). For practices in that group, Levin Group identifies this as a significant opportunity for practice growth and improvement.

With more competition due to aligners and the subsequent “price wars” that have developed, it has become essential for orthodontic practices to employ well-trained, highly professional treatment coordinators to anticipate parent and patient questions and convincingly explain why your orthodontic practice is the right choice. For practices that don’t have TCs, this is a wonderful opportunity to improve the number of starts while increasing the available time the orthodontist has to focus on treatment and clinical chair time.

Summary

Overall, the results of the survey seem quite positive this year. A slight decline in production did not dampen the optimism of this year’s respondents. Overhead will eventually stabilize, and practice profitability will improve as that occurs. And while staffing continues to be a challenge, more practices reported seeing more new patients.

Now that you’ve completed this article, you may want to consider reviewing the “What does this mean” sections. They contain suggestions based on the survey data and Levin Group experience for increasing practice production and efficiency—all of them applicable to most practices. I wish you an extraordinarily successful 2024.OP

Roger P. Levin, DDS, is the CEO and founder of Levin Group, a leading practice management consulting firm that has worked with over 30,000 practices to increase production. A recognized expert on orthodontic practice management and marketing, he has written 67 books and over 4,000 articles and regularly presents seminars in the U.S. and around the world. To contact Levin or to join the 40,000 dental professionals who receive his Practice Production Tip of the Day, visit levingroup.com or email [email protected].